Copy Trading with eToro – the world’s leading platform for social trading

Join millions of other traders.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.6

Copy Trading on eToro

Forget about asset managers! Make your own decisions and join the most popular social trading platform! On eToro (the number one platform) you can copy up to 100 traders.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Copy what?

Are you new to the world of copy trading? Well then welcome! With us you will receive all the latest information on the subject of copy trading. At the same time, we will also introduce you to eToro, one of the leading platforms for this social trading variant.

What exactly is copy trading?

Before we can enjoy ourselves, we have some work to do. In order for you to have the optimum market entry to copy trading, we have to familiarize you with a few terms that are relevant to the business of copy trading.

The first important term, which can also be understood as the generic term for copy trading, is social trading. It means what it says. Social trading offers people–the traders and copiers – to communicate to one another about stocks and investments. Due to this they can share information and advise each other. This communicative approach is what social trading is all about.

There are two forms of social trading: mirror and copy trading.

Mirror Trading

The copier (you) literally mirrors the trade of the trader (the person, you copy). This 1:1 copy, where trades and investments are copied all the same, is known as mirroring or mirror trading.

Copy Trading

The copier (you) copies selected trades from the trader (the person, you copy). In this case you can choose what trades you would like to copy and how much money you want to invest.

So much for the definitions of social trading. Now you already have a first rough overview of things. You will find out in the next section how copy trading looks in practice.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

“One copy trade, please.”

Ok, we admit, it is not that easy. There is a little more that you will have to do. First you will need to look for an appropriate platform. Besides eToro, which we will explore in some more detail later on, there are Wikifolio, AvaTrade, and many more. Whichever platform you decide to sign on to, the actual process of copy trading will basically remain the same. After you signed up, you can search for eligible trades and traders–the people you want to follow and copy. Once you find your candidates you can start with copy trading. Remember the meaning behind copy trading: as the term says, this is simply copying trades from traders.

How does copy trading work?

Let’s make things easy and use an example to illustrate the process of copy trading:

Let us assume that you copy trader X. In order to copy this trader, you need to decide on a specific amount that you want to invest. Once you have entered an amount, you simply click “copy”. From then on, you automatically invest in any trades that trader X invests in. This process is called “copy trader” or “trader copy”. Trader X has many trades from which you can choose, which ones you want to copy. For instance, trader X invests in Amazon. Trader X can comment on his trading decisions. He or she can explain why they chose to invest in Amazon. From this exchange you can determine whether this trade might be of interest to you as well. If you want to follow this trade from Amazon, you can select it in trader X’s trades. This process is known as “copy trades”.

So far, so good. Technically, copy trading is nothing more than a certain form of investment. You can take all the information that you need for a specific trade from the comment section. In this comment section investors and traders can share their experiences and learn from one another. Again, this is the primary function of social trading.

Insider Tip:

If you are new to copy trading or social trading in general, it is better to start with small amounts to minimise the risk of losing money.

* Past performance is not an indication of future results. The trading history presented is less than 5 full years and may not be sufficient as a basis for an investment decision.

Safety first

Now you might be wondering how you are supposed to know if those traders are trustworthy. Safety and reliability are everything in this matter. When you search for an appropriate social trading platform you need to keep an eye on security arrangements. Transparency is the keyword here. We have created a checklist to make sure that you get the best copy trading experience.

A good social trading platform should have all of the following:

-

Insight into trading history of traders

In order to be sure of who you are following, you need to have a look at the trading history of a trader. The trading history lists all trades that the trader has done, so that you can determine how successful the trader has been and whether his or her strategy suits you. -

Income of traders of traders

Traders that are eligible for copying earn money when they are copied. It is essential that you know how much they earn. That does not necessarily have to be an actual number, but some sort of indication on what benefits the trader gets if he or she is being copied. -

Open book of commissions

The book of commissions shows the stock price performance. If we use our example with the Amazon stock again, you could look into the performance of this stocking to see how the price has changed over a certain time period. This information is vital when determining which trades to copy. -

Fees

To follow trades usually requires fees now and then. These fees should be small amounts, so that you do not spend more money than you would potentially get back. -

Selection of traders

A good social trading platform is like a supermarket. There should be something for everyone. The same goes for traders. And we are not talking about a muscular, 30-year old hottie, but about pricing. Traders invest different amounts of money in trades. In order for you to do the same, you need to find traders that fall into the same price category as your intended investments. Do not settle for five traders or less; a good social trading platform will have a good selection of traders that fits your personal investment needs. -

Selection of investment products

There are many ways in which you can invest your money. A good social trading platform should have a wide selection of investment products that you can invest in. -

Regulation and license

Social trading platforms do not have stores that you can go to; they are online enterprises. As such, it is inevitable that they are licensed and regulated to provide security. Besides checking the license and regulation, you should also check whether your chosen platform has a customer service in your required language and if there is any contact information provided. Automated live chats are a no-go. After all, this is about your money.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Advantages of Copy Trading

Even if it seems as if copy trading had many rules, the advice that we give you on this site pretty much applies to any online stocking business. The truth is that copy trading is neither hard to understand nor complicated in practice. That is why it has become so popular in the first place. Since copy trading involves the direct exchange between traders and copiers you can easily determine what happens with your preferred trades. Additionally, copy trading has a few more advantages towards other investment options such as asset managers:

Time is money

Just like this popular saying, copy trading knows about the value of time in regards to finances. Once you have copied a trader and your preferred trades, you can sit back and enjoy the show. Copy trading saves you time and money by being an automated and cheap alternative to asset managers.

Learning through networking

With copy trading you can learn from the best: chat with the most experienced and successful traders and learn their strategies. You can use your social trading platform just like you would use a social network.

Stay in charge

Whatever your copied trader is doing, in the end you stay in charge of your finances. You can unfollow a trader as quickly as you followed him by pausing or stopping the copying.

Copy vs. Mirror Trading

Well, copy trading sounds nice, but you are curious about the differences to mirror trading? We have the answers to your questions!

These two forms of social trading differ in their implementation if you will. This may not sound like a big deal, but it does have a great impact on your investment strategy. To show you exactly what we mean by this, we made a direct comparison between the two trading forms:

Beginner-friendly

With mirror trading you adopt all trades of a copied trader. For someone who may be new to the online stock market, this can be quite a tricky situation. After all, you may not be familiar with some trades or not interested in following all of them. With copy trading, however, you can slowly but surely make your way into the market, for instance, by copying only one trade.

Your choice

Mirror trading means that you copy a trader 1:1, which includes the invested amount. If, for example, trader X invests 500 € in Amazon, you will do the same. With copy trading you decide on the trades you want to copy as well as the amount you want to invest.

The advantages of copy trading over mirror trading show the small, yet distinct difference between the two. In conclusion we can say that copy trading is certainly the user-friendlier option and leaves you with more discretion than mirror trading.

Social Trading Plattform eToro

copytrader, copytrading, trader copy, copy trading platforms… many terms, one solution: eToro

As promised we would like to familiarize you with one of the leading social trading platforms: eToro. Let us start with a few essential quick facts:

- multinational enterprise

- founded in 2007 in Tel Aviv

- offices in Israel, the UK, USA, and Cyprus

- available in various languages

- licence Nr. 109/10

- regulated by the Cyprus Securities Exchange Commission(CySEC)

As you can see, eToro already has some of the key characteristics of a good social trading platform. It offers services in German and has a licence. Those aspects should not be underestimated in the online stock market world. But of course there are some more features involved.

Let us use our checklist on how to spot a good social trading platform:

- Customer service in local language

- Licence in US

-

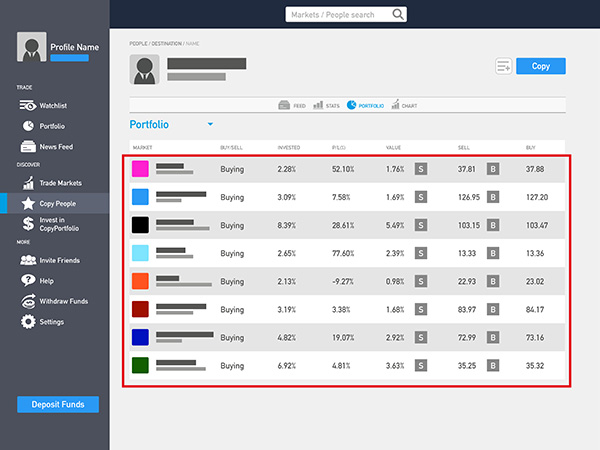

Transparency (open book of commissions and trader history)

eToro gives you the opportunity to look at a trader’s history. This includes statistics on his success as well as his portfolio of invested trades. The same applies to accessing the book of commissions to check on a trade’s development. -

Fees

To follow trades usually requires fees now and then. These fees should be small amounts, so that you do not spend more money than you would potentially get back. -

Selection of investment products

eToro has a variety of investment products, including ETF’s, stocks and crypto assets, such as bitcoins. -

Selection of traders

The “copy people” tab takes you to eToro’s trader page, which lists all traders. You may do a confined search by looking for traders from a certain nation or with a certain percentage. Also, you can copy up to 100 traders.

Honestly, you could not be doing better on a test, could you?

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How does eToro work?

And here is the question you have been asking yourself since eToro successfully completed our checklist: how does the CopyTrader on eToro work?

Select a trader

Search for traders by performance, assets, risk score and more

Set an amount

Choose a total amount for copying – the proportions will be calculated automatically

.

Click on “Copy”

Click the “Copy” button to automatically start copying the trader’s positions.

First, you have to register for free. Then you can pretty much start trading. On the “top markets” tab you get to the trader page, where you can look into traders and markets. On that page you can choose your traders. Once you found one or several traders that you want to copy, you simply have to enter an amount that you want to invest. There is a minimum amount that you have to invest, which changes occasionally. Recently the minimum amount was raised by 300 USD from 200 to 500 USD. However, this is only temporarily. After you entered an amount, you simply click “copy”. eToro will take care of everything from here on. Every time your copied trader invests more money or in another trade, so will you.

Finding the best traders

eToro makes the search for the best traders an easy one; after all, time is money, and eToro knows it. That is why eToro’s user-friendly website proves very helpful in finding the best traders for you. In the following we will explain how you can find the best suitable traders for your investment and what you have to look out for step by step.

Step 1

The “top markets” tab on the main page takes you to the market page. This page has all of eToro’s traders, which you can find under the tab “copy people”. Here you will find a first rough classification. The traders are subdivided into categories, such as “recommended by the issuer” or “most copied”. This rough classification is sufficient enough if you are not looking for a specific percentage, nationality or investment product.

Step 2

On the top of the “copy people” page you will find a search bar with filters. Using this, you can look for specific categories, for instance, investment products or percentages.

Step 3

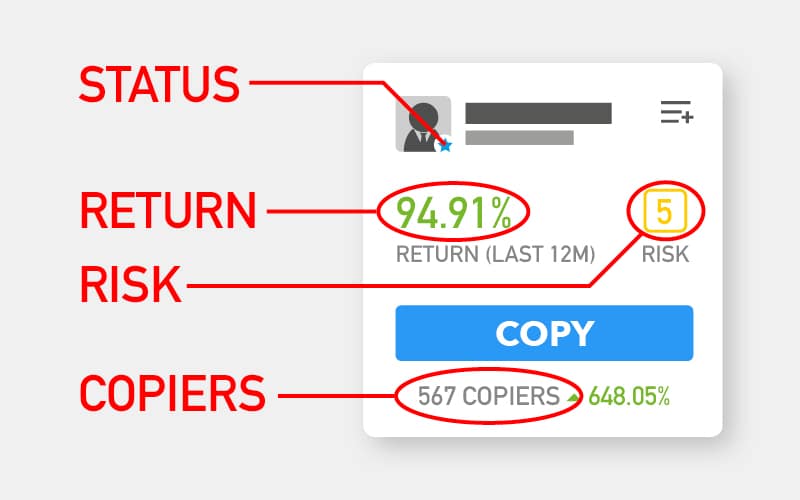

After you applied one or more filters, eToro shows you the traders, their return and risks. You have the option to choose more selection criteria, such as performance, trading and advanced.

The trader profiles have the following information:

return: it is important to check a trader’s history. The “return” information gives you a good first overview of a trader’s success. You can get some more information by clicking on a trader’s profile.

risk: this “risk” is about the one you take if you decide to follow a trader.

copiers: this is the number of copiers that a trader already has.

status: single, married, wait…wrong status. With the little star symbol eToro actually refers to the status of a trader in its popular investor program. This program offers investors the chance to be copied and thus, raise their managed assets. Blue stands for cadet, red for champion, green for elite and black for elite pro.

Copy trading experiences with eToro

Experiences with copy trading are a peculiar thing. As with all experiences in life, copy trading receives mixed reviews, too. There are the ones that love copy trading and then there are those who dislike it. The issue with negative reviews is that people do not talk about the actual reason for their bad experiences. After all, bad experiences are not a wondrous phenomenon, but rather a brought on occurrence based on the ignorance of social trading beginners.

* Past performance is not an indication of future results. Trading history shown is less than 5 complete years and may not be sufficient to form the basis of an investment decision.

So far we have given you a lot of tips about traders and copy trading in general. But there is one more aspect that is crucial for a positive copy trading experience: the copy trading strategy. In fact, the reason for some of the bad reviews towards copy trading is that the person has not used any strategy for his or her investments. Of course you do not have to be a financial genius to take part in copy trading, but it is still advisable to use a strategy; after all, it is about your money. For this you do not need to have a degree in financial management. Rather, you should remember the number one rule for stock market trading:

The higher the return, the higher the risk.

In other words, if you want more money to come out of your deal, you have to be willing to take a higher risk.

While we are at it, we might as well share another wisdom with you:

Patience will be rewarded.

Copy trading makes the market more transparent and as such, easier, but it will not turn you into a millionaire overnight. Make sure you take a good look at your traders, especially their trading past. If a trader has got a fast and high return, you should rather leave that one. We advise you to copy a trader who has shown a stable improvement over the course of at least six months. Give your investments time; this rule does not only apply to copy trading, but for any other form of investment you may use.

The good thing about copy trading is that you can consult with traders. This is the key aspect of social trading: the direct exchange between investors and traders. this way you can learn from experts and thus, make successful investments. Platforms, such as eToro, offer a perfect start into the world of social trading. Especially copy trading (eToro’s speciality) is made particularly easy here.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQ

When you do copy trading you are the copier. This means that you copy a trader and his trades. In order to do so, you have to set an amount that you want to invest.

When you do copy trading you are the copier. This means that you copy a trader and his trades. In order to do so, you have to set an amount that you want to invest.

Nein, ihren Account können Sie nicht pausieren. Sie können aber Ihr Copy Trading pausieren oder stoppen. Die Änderungen können Sie unter Einstellungen vornehmen. Ebenso können Sie ihren investierenden Betrag ändern.

Yes, of course you can. This is one of the main points of social trading. It is supposed to adapt the stock market to the technology of the 21st century. eToro has its own app that you can download from the App Store or Google Play Store. This way you can copy trade whenever, wherever you want.

The minimum amount you need to invest with eToro is usually $200, however this value may vary depending on the country. Recently, this amount was temporarily increased to $500.

The maximum amount is set at 2.000.000 USD.

Automated trading is sometimes used in copy trading, since once you copied a trader, you automatically do all the trades that he does. However, the term fits better with mirror trading, where you copy a trader 1:1 and automatically take on all the trades and investments.

The CopyTrader™ is the trading program on eToro, which provides you with the platform for copy trading.

eToro is a multi-asset platform that offers investing in stocks and crypto assets as well as trading CFDs.

Please note that CFDs are complex instruments and carry a high risk of losing money quickly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. The trading history presented is less than 5 full years and may not be sufficient as a basis for an investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

eToro USA LLC does not offer CFDs and assumes no responsibility for the accuracy or completeness of the contents of this publication, which was prepared by our partner using publicly available, non-company-specific information about eToro.